In Our Opinion:

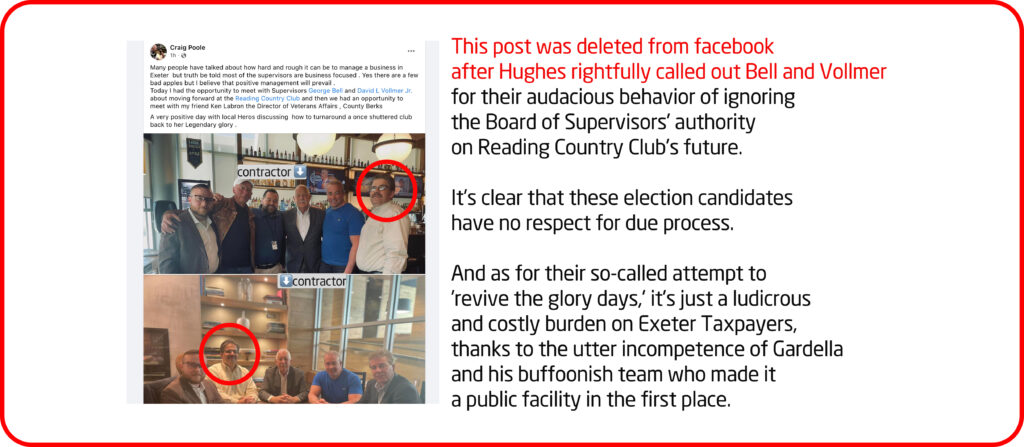

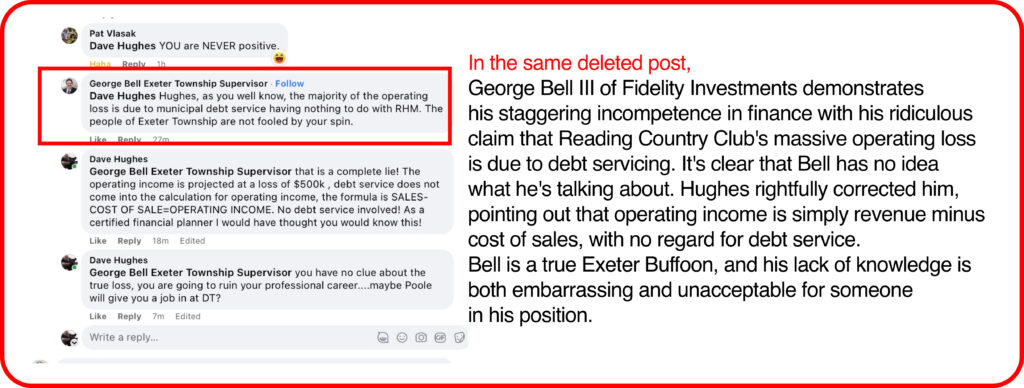

After rigorously examining public supervisor meetings, official statements, and social media activity over the past year, we find it deeply troubling that George Bell exhibits a significant deficiency in integrity. This is unequivocally unacceptable for an individual seeking to oversee a $15 million annual budget, with more than $45 million in cash assets held in financial institutions. The situation becomes even more alarming, considering that George Bell is purportedly employed as a financial planner with Fidelity Investments – a role that demands the utmost honesty and ethical conduct.

As a matter of fact, when someone lacks integrity, like hiding their bankruptcy or spreading lies about others, you can say they’re being dishonest and untrustworthy. They’re not being true to themselves or others, and it’s hard to rely on their words or actions.

In addition, It is wrong and dangerous to have a candidate with serious lapses in integrity running for office because:

- Trust: People need to trust their leaders. If a candidate is dishonest, it’s hard for citizens to believe in their promises or rely on them to make good decisions.

- Decision-making: Integrity is crucial for making ethical and responsible choices. A candidate with low integrity might prioritize personal gains over public interest, leading to harmful consequences for society.

- Accountability: A leader should be accountable for their actions. Lapses in integrity can result in a candidate evading responsibility and not being transparent about their decisions.

- Role model: A public leader serves as a role model for the community. A candidate with serious integrity issues can negatively influence the values and behaviors of others, promoting a culture of dishonesty and corruption.

- Stability: An untrustworthy leader can create uncertainty and instability in government. People may question the legitimacy of their policies, and this can lead to public unrest and division.

- Reputation: A candidate with serious lapses in integrity can damage the reputation of the office they hold and the government they represent, both nationally and internationally. This can undermine the country’s credibility and relationships with other nations.

- Democracy: For democracy to function effectively, leaders must be honest and transparent. A candidate who lacks integrity can erode public trust in the democratic system and lead to disillusionment and disengagement from the political process.

And lastly, If a financial planner working for Fidelity Investments hides a bankruptcy on their record and spreads malicious lies about an investor, it raises serious concerns about their integrity and professionalism. Such behavior can be described as:

- Dishonest: Hiding a bankruptcy and spreading lies indicate a lack of honesty, which is a critical trait for someone in a financial planning role. Clients rely on financial planners to provide accurate information and trustworthy advice.

- Unprofessional: Spreading malicious lies about an investor is unprofessional conduct that goes against the ethical standards expected of financial planners. This behavior can harm the reputation of the financial planner, Fidelity Investments, and the financial planning profession.

- Unreliable: A financial planner with a history of dishonesty may not be reliable in providing sound financial advice or managing clients’ investments, potentially putting their clients’ financial futures at risk.

- Breach of trust: Clients trust financial planners with their sensitive financial information and depend on them to act in their best interest. Hiding important information and engaging in malicious behavior can erode clients’ trust in their financial planner and the company they represent.

- Reputation risk: Such actions can damage the reputation of Fidelity Investments, leading to a loss of clients, mistrust in the company, and potential legal consequences.

- Ethical concerns: Financial planners are expected to adhere to a strict code of ethics. Engaging in dishonest practices and spreading false information are clear violations of these ethical guidelines and may result in disciplinary action or termination of employment.

In summary, it is abundantly clear that George Bell exhibits a profound absence of integrity, rendering him entirely untrustworthy in protecting the interests of clients or maintaining the esteemed reputation of his employer and profession. Given these glaring shortcomings, entrusting him with a public office of significant financial responsibility, coupled with the heightened risk and potential for corruption, is unequivocally inadvisable and ill-advised.